Municipals weakened further Thursday as outflows from muni mutual funds lessened, while short-term U.S. Treasury yields fell after Fed Chairman Jerome Powell suggested central bankers could raise rates again, but not at the upcoming meeting. Equities sold off.

The two-year muni-to-Treasury ratio Thursday was at 71%, the three-year was at 71%, the five-year at 70%, the 10-year at 72% and the 30-year at 89%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 71%, the three-year at 72%, the five-year at 71%, the 10-year at 73% and the 30-year at 91% at 4 p.m.

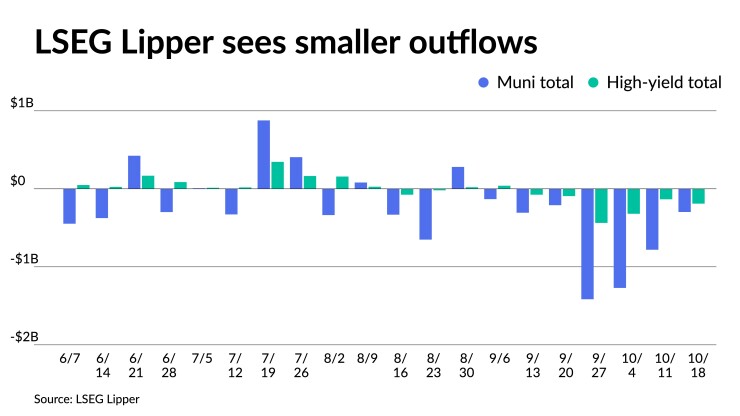

LSEG Lipper data Thursday reported $297 million of outflows from municipal bond mutual funds for the week ending Wednesday after $780.1 million of outflows the week prior.

High-yield saw outflows of $189.8 million after outflows of $134 million the previous week.

As tax-exempts continue to follow the Treasury market to higher yield levels, the “higher-for longer” mantra is alive and well as cuts were seen along the entire curve on Thursday, said Jeff Lipton, head of municipal credit and market strategy at Oppenheimer.

“There was a slight pullback on yields last week due to a flight-to-quality after the Israel-Hamas unrest, but with so much supply in the secondary market, yields have come back up and seem to be looking to stay here for now,” said Bill Walsh, president of Hennion & Walsh Inc.

“The heavy new-issue muni calendar this week has been met with strong competitive bids with good overall presale interest,” Lipton noted.

“Institutional [separately managed account] activity has backed away this week as the sell-off unfolded, and front-end liquidity has been challenged with the unsettled Treasury market,” he added.

The retail investor remains fixated on ever-cheapening levels with the ability to wait and see what happens next, and jump in opportunistically as value presents itself and finds a home for available cash, Lipton said.

“Before the start of the traditional ‘blackout period’ this Saturday, we received heavy doses of Fed-speak that, on balance, seemed content with the central bank proceeding with caution and even Chair Powell in his Thursday interview hinted at a possible pass at the upcoming FOMC,” he added.

Prior to Powell’s speech at the Economic Club of New York Thursday afternoon — which Scott Anderson, chief U.S. economist and managing director at BMO Economics, said “hit all the right notes for investors” — UST yields had risen two to four basis points.

But after his speech, short-term UST yields reversed course and fell while UST yields out long rose even further.

Muni yields were cut two to five basis points before Powell spoke, and were only a basis point weaker in spots at 1:30 p.m. before being cut another basis point or two by 4 p.m.

After the speech, the probability of a rate hike at November’s Federal Open Market Committee meeting “fell to 3.6% in the fed funds futures market, while the probability of a December rate hike slipped to 28%,” Anderson noted.

While not breaking a lot of new ground, Powell’s comments “hint at a pause in November, but they also leave the door open for another rate hike at some point should growth and inflation fail to moderate,” he said.

Powell noted, “the committee is ‘proceeding carefully” and Anderson said, “significant tightening in financial conditions, largely caused by higher bond yields, can have implications for policy.”

“A nod to the sharp rise in long-term Treasury yields may be doing the work for the Fed, so less of a need to hike again,” he said.

Powell added, “there may still be meaningful tightening in the pipeline” and the policy stance is “restrictive.”

The rate backdrop is one of “caution,” said James Pruskowski, chief investment officer at 16Rock Asset Management.

“We’re testing key support levels around 5%, on government 10 years, and fixed income trades have the market is on its heels, not on its toes,” he said.

“We’re searching for a higher risk term premium, we’re building in a supply concession, and we’re responding to stronger economic data,” he added.

So the “full cycle is first there were inflation worries, then it was the Fed, and now it’s focused on deficits, more recently focused on currency interventions,” Pruskowski said.

Pruskowski said markets are performing “pretty well.”

“There’s a bifurcation of demand going on between softening of liquidity in the secondary market versus new issues, which are priced attractively but still being well oversubscribed,” he said.

There is also a seasonal uptick in issuance that has created a “generational opportunity” to lock in long-term value, especially for qualified investors,” he said.

One of the things about the uncertain backdrop and rising rates is that it warrants sheltering in top-rated asset classes, despite the challenging liquidity environment, he said.

Credit conditions and monopolistic powers in munis define that window of opportunity, he said.

In the primary market Thursday, BofA Securities priced for the West Virginia Hospital Finance Authority (Baa1/BBB+//) $410.365 million of hospital refunding and improvement revenue bonds on behalf of the Vandalia Health Group), Series 2023B, with 5s of 9/2040 at 5.10%, 5.57s of 2043 at 5.52%, 6s of 2048 at 5.60%, 5.5s of 2048 at 5.48%, 6s of 2053 at 5.64% and 5.375s of 2053 at 5.52%, callable 9/1/2033.

Piper Sandler & Co. priced for the Washington State Housing Finance Commission (/BBB//) $136.190 million of Seattle Academy of Arts and Sciences Project nonprofit revenue and refunding revenue bonds, with 5s of 7/2028 at 5.02%, 5.125s of 2033 at 5.24%, 5.625s of 2038 at 5.79%, 5.875s of 2043 at 6.05%, 6.125s of 2053 at 6.26%, 6.25s of 2059 at 6.36% and 6.375s of 2063 at 6.67%, callable 7/1/2030.

Morgan Stanley priced for the Colorado School of Mines Board of Trustees (A1/A+//) $132.485 million of fixed-rate institutional enterprise revenue bonds, Series 2023C, with 5s of 12/2025 at 3.83%, 5s of 2028 at 3.80%, 5s of 2033 at 4.05%, 5s of 2038 at 4.54%, 5.25s of 2043 at 4.82%, 5.25s of 2048 at 5.03% and 5.25s of 2053 at 5.12%, callable 12/1/2033.

Stifel, Nicolaus & Co. priced for the Brownsburg 1999 School Building Corp., Indiana, (/AA+//) $103.590 million of ad valorem property tax first mortgage bonds, with 5s of 7/2024 at 4.18%, 5s of 2028 at 4.02%, 5s of 2033 at 4.23%, 5.25s of 2038 at 4.64% and 5.5s of 2043 at 4.92%, callable 7/15/2031.

Muni CUSIP requests fall

Municipal CUSIP request volume fell in September on a year-over-year basis, following an increase in August, according to CUSIP Global Services.

For muni bonds specifically, there was a decrease of 18% month-over-month and an 11.6% decrease year-over-year.

The aggregate total of identifier requests for new municipal securities, including municipal bonds, long-term and short-term notes, and commercial paper, fell 11.4% versus August totals. On a year-over-year basis, overall municipal volumes were down 8.8%. CUSIP requests are an indicator of future issuance.

Secondary trading

Maryland 5s of 2024 at 3.80% versus 3.74%-3.65% Wednesday. LA DWP 5s of 2024 at 3.56% versus 3.46% on 10/13 and 3.68% on 10/6. NYC 5s of 2024 at 3.81%-3.80%.

Ohio 5s of 2027 at 3.57% versus 3.59% Wednesday. Georgia 5s of 2028 at 3.49% versus 3.47% Wednesday. California 5s of 2029 at 3.63%.

Connecticut 4s of 2032 at 4.03%. Arizona DOT 5s of 2033 at 3.72%. Massachusetts 5s of 2034 at 3.74%.

Washington 5s of 2048 at 4.81%-4.80% versus 4.59%-4.57% Monday and 4.40%-4.50% on 10/12.

AAA scales

Refinitiv MMD’s scale was cut five to eight basis points: The one-year was at 3.78% (+8) and 3.67% (+5) in two years. The five-year was at 3.49% (+5), the 10-year at 3.59% (+6) and the 30-year at 4.53% (+6) at 3 p.m.

The ICE AAA yield curve was cut four to six basis points: 3.73% (+4) in 2024 and 3.71% (+5) in 2025. The five-year was at 3.53% (+5), the 10-year was at 3.58% (+6) and the 30-year was at 4.55% (+6) at 4 p.m.

The S&P Global Market Intelligence municipal curve was cut six to eight basis points: The one-year was at 3.81% (+8) in 2024 and 3.71% (+6) in 2025. The five-year was at 3.54% (+6), the 10-year was at 3.60% (+6) and the 30-year yield was at 4.54% (+6), according to a 3 p.m. read.

Bloomberg BVAL was cut five to seven basis points: 3.80% (+5) in 2024 and 3.74% (+5) in 2025. The five-year at 3.52% (+5), the 10-year at 3.62% (+6) and the 30-year at 4.56% (+6) at 4 p.m.

Treasuries were weaker out long.

The two-year UST was yielding 5.157% (-3), the three-year was at 5.011% (-2), the five-year at 4.947% (+3), the 10-year at 4.978% (+8), the 20-year at 5.330% (+9) and the 30-year Treasury was yielding 5.097% (+11) near the close.

NYC TFA $1B deal

The New York City Transitional Finance Authority said it received more than $336 million of orders during the retail order period for its sale of $1 billion of tax-exempt future tax-secured subordinate bonds.

The TFA also saw about $2 billion of priority orders during the institutional order period, which made the issue around 2.3 times oversubscribed

Given investor demand for the bonds, yields were cut three basis points in 2025 and 2038; by two basis points in 2036, 2037 and 2039 through 2042; and by one basis point in 2026 through 2030, 2032, 2033, 2043 and for the 5.50% coupon bonds in 2044 and 2053. Final yields ranged from 3.67% to 5.00%.

Proceeds from the sale will be used to fund capital projects.

The bonds were priced by book-running lead manager Ramirez & Co. BofA Securities, Citigroup, Jefferies, J.P. Morgan, Loop Capital Markets, RBC Capital Markets, Siebert Williams Shank and Wells Fargo Securities were co-senior managers on the deal.

Christine Albano and Chip Barnett contributed to this story.