Municipal bond prices weakened again Monday as the market looked ahead to a $6.3 billion slate of sales led by two big deals from issuers in Texas and Florida.

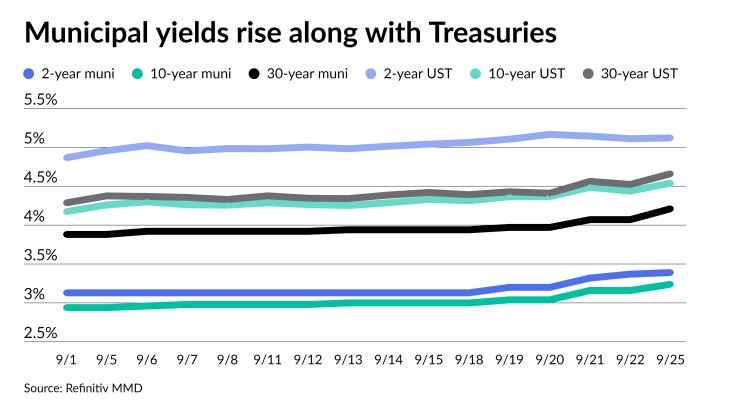

Municipals continued the selloff seen last week, with yields rising Monday by as many as 12 basis points. Treasury yields also rose while stock prices ended mixed.

The two-year muni-to-Treasury ratio was at 68%, the three-year was at 69%, the five-year at 70%, the 10-year at 72% and the 30-year at 90%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 69%, the three-year at 71%, the five-year at 70%, the 10-year at 74% and the 30-year at 93% at 3 p.m.

Uncertainty swirled through the municipal market on Monday as interest rates continued to spike and liquidity remains suspect, causing investors to hunker down on the sidelines, according to John Farawell, managing director of underwriting at Roosevelt & Cross.

“People are just kind of sitting on their hands and being careful because MMD is raising yields every day and people don’t know which way this is heading,” Farawell said Monday.

The municipal market has followed on the heels of the Treasury market, which has risen by 475 basis points in some spots in the last couple of years. The rate spike was underscored by the 10-year Treasury benchmark yield hitting 4.52%, an increase of 50 basis points in the last few weeks, he noted.

“Rates spiked up across the board 30 to 40 basis points so far this month, and in some spots even 50,” Farawell said.

Looking at new issues, he noted activity will depend on the buyer.

“They will buy at the right price, but they are not jumping in yet because of the uncertainty,” Farawell said.

“Some retail investors will not be buying until the market settles down a bit,” he added.

He suggested this week’s $629 million New York City Municipal Water Finance deal is a strong, well-known credit that should stir attention on the long end of the deal — 2034 to 2053 — among some eager retail and institutional investors.

“It’s a great essential service credit that has not been in the market in a while — and supply is not outrageous right now,” Farawell said, predicting the credit could be oversubscribed.

In spite of the rate spike, there is currently favor elsewhere in the market among sophisticated investors for attractive good quality credits on the long end with 5% yields priced at a discount, such as hospital bonds where the spread to the plain-vanilla general market is roughly 75 basis points, according to Farawell.

Meanwhile, he noted the front end has also gotten very attractive, with the one-year Treasury benchmark yielding 5.15% and two-year yielding 5.11%.

Rates & Returns: What’s next?

Inflation and interest rate concerns remained on investors’ minds as the week began.

With the selloff in munis last week, the month-to-date returns for munis fell to negative 1.42% and brought year-to-date returns to just 0.15%, according to AmeriVet Securities.

“This selloff last week was brought upon by many expecting the Federal Reserve to have a timeline of when they expect to cut interest rates, but the Fed said they expect to have rates higher for longer than many expected,” Jason Wong, vice president of municipals at AmeriVet, wrote in a Monday report.

“If we continue to trend into negative territory, this will be the second year in a row that muni year-to-date returns were negative,” he said. “The one positive to this selloff is that we did see muni-to-Treasury ratios move higher as munis have become increasingly expensive over the past year.”

According to report from BofA Global Research, Federal Reserve Chair Jerome Powell effectively confirmed last week the Fed is pretty much done raising rates for the year.

“One more hike may or may not happen later this year, but for all practical purposes we are at the peak,” Oleg Melentyev, credit strategist at BofA, wrote in Friday’s report. “The conversation now shifts firmly into how long rates could stay here and this is where the market was disappointed to learn that the Fed has removed two potential cuts from its 2024 SEP.”

He pointed out that Powell refused to say that a soft landing remains his base case, although it is clearly a desirable outcome.

“We continue to think that the market got carried away with a rosy outlook of deep cuts in a non-recessionary scenario,” Melentyev said. “Residual inflation appears set to remain stubborn with wages and energy as main drivers. Both higher wages and energy prices have one common side-effect — they feed into the cost of most products and services.”

“The end result of this is either inflation, if the cost is being passed to the end-user, or a margin squeeze if it’s not. In 2021-22 it was more of the former; now we think it’s shifting to the latter,” he said.

“These factors will weigh in on business expansion and capital allocation decisions across industries in coming months,” Melentyev added. “The lagged effect is forming; its full impact is unknown.”

According to Will Compernolle, macro strategist at FHN Financial, the next couple weeks will see commentary coming from the Fed that will help markets understand a few lingering mysteries from last week’s Federal Open Market Committee’s meeting.

“First, FOMC participants’ public comments before the meeting suggested a slight consensus in favor of no more rate hikes — was this because of a vocal minority, or were some participants swayed during the meeting or pre-decision silent period?” he wrote in a Monday report.

“Second, how can 5.1% end-2024 fed funds be paired with core PCE inflation at 2.6% at the end of next year without monetary policy being overly restrictive?” he asked.

“Third, judging by the range of GDP and unemployment rate estimates through 2025 (not just the medians), is it true that all FOMC participants project a soft landing? The dot plot and SEP don’t always tell an entirely cohesive story, but answering these questions would help markets understand the Fed’s outlook and conviction for higher rates,” Compernolle said.

Primary market focus

Volume for this week is estimated by S&P Global’s Ipreo at $6.3 billion, consisting of $5.3 billion of negotiated deals and $1.0 billion of competitive sales. This year’s weekly average volume has been $6.2 billion, according to MMD.

The biggest deal of the week is coming from the Lone Star State.

Wells Fargo Securities is expected to price the Texas Water Development Board’s (NR/AAA/AAA/NR) $1 billion of State Water Implementation Revenue Fund for Texas (SWIRFT) master trust revenue bonds on Wednesday.

The deal consists of $998.1 million of Series 2023A tax-exempt bonds and $5.1 million of Series 2023B taxables.

Proceeds from the SWIRFT sale will finance a drinking water treatment plant expansion for the North Texas Municipal Water District along with projects for 11 other borrowers, including the cities of Austin and Dallas, as well as for regional water districts and authorities.

Co-managers include BOK Financial Securities, Frost Bank, Jefferies, Mesirow Financial, Morgan Stanley, Piper Sandler, Ramirez & Co., Raymond James, Siebert Williams Shank and Stifel, Nicolaus. HilltopSecurities is the financial advisor while McCall Parkhurst & Horton is the bond counsel.

Bloomberg News

Following close behind is the Florida Development Finance Corp., which has a $770 million tax-exempt deal on tap for Brightline Florida Holdings LLC. Morgan Stanley is remarketing the Series 2022A bonds on Tuesday as the new Series 2023C (NR/NR/NR/NR) revenue bonds, subject to the alternative minimum tax, which were issued for the Brightline Florida passenger rail expansion project.

The remarketing comes after Brightline launched service between Orlando and Miami Friday, adding 170 miles of trackage to its 70-mile passenger train between Miami and West Palm Beach.

The project has roughly $3.7 billion of bonds outstanding, which were sold from 2019 to 2023.

Up North, there are two large deals coming from New York issuers.

The New York City Municipal Water Finance Authority (Aa1/AA+/AA+/NR) is coming to market with a $630.5 million issue of Fiscal 2024 Series AA water and sewer system second general resolution revenue bonds. Raymond James is expected to price the bonds on Wednesday. Proceeds will be used to fund improvements to the city’s water and sewer system and refund some outstanding water bonds.

BofA Securities is set to price New York State’s (Aa1/AA+/AA+/AA+) $543 million of general obligation bonds on Thursday. The deal consists of tax-exempt Series 2023A, Series 2023B tax-exempts, Series 2023C tax-exempt refunding bonds and Series 2023D taxables.

Out West, Goldman Sachs is set to price the California State Public Works Board’s (Aa3/A+/AA-/NR) $625.235 million of Series 2023C various capital projects lease revenue refunding bonds on Wednesday.

The biggest competitive deal on the calendar is from Rutherford County, Tennessee, (Aaa/AA+/NR/NR) which is set to sell $175 million of GOs at 10:30 a.m., ET, Wednesday.

Secondary market trades

New York City Transitional Finance Authority 5s of 11/1/2028 [64971XB72] traded in a block of $1 million on Monday at 107.061 to yield 3.475%, according to ICE. The 5s were originally priced in August 2021 at 129.836 to yield 0.74%.

A block of $5 million+ of Massachusetts State Transportation Authority 5s of 6/1/2050 [57604TKJ4] traded at 103.956 to yield 4.49%. The 5s were originally priced in October at 105.561 to yield 4.29%.

A block of $2.45 million of California state 5s of 9/1/2043 [13063D5R5] traded at 107.008 to yield 4.132%. The 5s were originally priced earlier this month at 109.094 to yield 3.89%.

A block of $2.83 million of University of California 5s of 5/15/2041 [91412HPR8] traded at 108.407 to yield 3.942%. The 5s were originally priced in February at 112.251 to yield 3.56%.

AAA scales

Readings of Refinitiv MMD’s AAA 5% GO scale showed yields rising as much as 12 basis points Monday. The one-year was at 3.57% (+12) and the two-year was at 3.49% (+12). The five-year was at 3.22% (+10), the 10-year at 3.26% (+10) and the 30-year at 4.17% (+10) at 3 p.m.

The ICE AAA yield curve saw yields rise as much as 12 basis points. The one-year was at 3.58% (+12) in 2024 and 3.52% (+12) in 2025. The five-year was at 3.23% (+12), the 10-year was at 3.24% (+11) and the 30-year was at 4.21% (+10) at 3 p.m.

Yields along the S&P Global Market Intelligence (formerly known as IHS Markit) municipal curve were higher. The one-year was at 3.58% (+12) in 2024 and 3.49% (+12) in 2025. The five-year was at 3.24% (+10), the 10-year was at 3.26% (+10) and the 30-year yield was at 4.17% (+10), according to a 3 p.m. read.

Treasury prices were mostly weaker.

The two-year UST was yielding 5.12% (+1), the three-year was at 4.82% (+2), the five-year at 4.62% (+5), the 10-year at 4.54% (+10), the 20-year at 4.9% (+13) and the 30-year Treasury was yielding 4.66% (+13).

The Dow Jones Industrial Average was down 0.6%, the S&P 500 rose 0.2% while the Nasdaq Index dropped 0.5%.

Negotiated deals ahead

Siebert Williams Shank is set to price the Wayne County Airport Authority, Michigan’s (A1//A/AA-) $375.025 million of airport revenue bonds on Wednesday for the Detroit Metropolitan Wayne County Airport, consisting of $108.36 million of Series A; $82.47 million of Series B; $137.76 million of Series C; $18.225 million of Series D; and $28.21 million of Series E.

J.P. Morgan Securities is expected to price the Missouri Health and Educational Facilities Authority’s (A1/A+/NR/NR) is set to price $294.26 million of Mercy Health Facilities revenue bonds on Tuesday.

BofA Securities is set to price for the Pennsylvania Economic Development Financing Authority (/A-//) $150 million of Series 2021A-2 solid waste disposal revenue bonds on Wednesday.

Raymond James is expected to price Fort Myers, Florida’s (Aa3/AA-//) $139.43 million of Series 2023 utility system refunding and revenue bonds on Tuesday.

PNC Capital Markets is set to price Durham, North Carolina’s (Aa1/AA+/AA+/) $128.3 million of Series 2023 limited obligation bonds on Thursday.

J.P. Morgan Securities Is expected to price the San Francisco Public Utilities Commission’s (NR/AA/AA-/NR) $121.66 million of Series 2023A power revenue bonds on Wednesday.