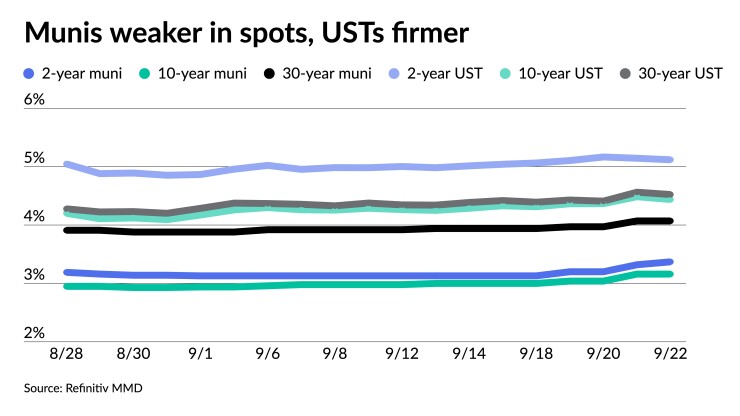

Munis were weaker Friday ahead of a larger new-issue calendar. U.S. Treasuries saw yields fall, and equities ended the trading session up.

The two-year muni-to-Treasury ratio Friday was at 66%, the three-year was at 67%, the five-year at 68%, the 10-year at 71% and the 30-year at 90%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the two-year at 66%, the three-year at 67%, the five-year at 67%, the 10-year at 70% and the 30-year at 90% at 4 p.m.

Following the “rather hawkish” Fed where rates were held steady but forward guidance suggested another rate hike this year and fewer cuts in coming years, USTs on Thursday moved “higher and finally broke out of the trading range,” said Barclays strategists Mikhail Foux, Clare Pickering and Mayur Patel.

The five-, 10-, 20- and 30-year UST yields reached multi-level highs Thursday, but USTs rebounded Friday, as yields fell three to six basis points.

Munis followed USTs Thursday, joining bond markets in a rout. But unlike USTs, muni yields rose further Friday, with triple-A benchmarks cut up to five basis points, depending on the scale.

In the near term, CreditSights strategists Pat Luby and Sam Berzok said they expect “weaker prices and higher yields,” but noted, “tax-exempt yields are attracting the attention of income-oriented individual investors as demand for tax-exempt income has been steady, if stealthy.”

Demand, though, may be hard to see based on muni mutual funds net flows, which they said have been “lackluster” this year, totaling $1.1 billion as of Sept. 13.

This is better than calendar year 2022 when muni mutual funds saw $148 billow of outflows, but is “unlikely to get close” to the average of the past five years of $49 billion of inflows, according to CreditSights strategists.

However, long-duration funds are up year-to-date, while short-term funds are down, they said.

Through the end of July, net flows totaled $5.4 billion. Short-term funds lost $10 billion as long-term national funds pulled in $16.1 billion. Flows into muni exchange-traded funds totaled $3.1 billion as of July 31, they noted.

While it might be premature, Barclays strategists said, “investors should stay alert for any attractive buying opportunity in the near future.”

While the 30-day visible supply is “not overwhelming,” they anticipate that issuance will pick up in October, which is usually the heaviest issuance month of the year, they said.

“It might put additional pressure on the market, which is already somewhat vulnerable after the rates move,” they said.

There may also be heavier outflows due to the volatility with UST rates, they said. Refinitiv Lipper reported $27.444 million was pulled from municipal bond mutual funds for the week ending Wednesday after $116.737 million of outflows from the funds the previous week.

However, Barclays noted that “for investors willing to take a longer-term view, current yields and valuations versus Treasuries have started to look attractive.”

They believe investors in high-tax brackets may become more interested in munis.

“We still believe that stronger performance in November-December for the asset class is a likely possibility, and market participants should be positioned accordingly,” they said.

New-issue calendar

The calendar will rebound with an estimated $6.342 billion next week with $5.334 billion of negotiated deals on tap and $1.009 billion on the competitive calendar.

The Texas Water Development Board leads the negotiated calendar with $1 billion of revenue bonds, followed by $770 million of revenue bonds from the Florida Development Finance Corp., $630 million of water and sewer system second general resolution revenue bonds from the New York City Municipal Finance Authority and $625 million of the lease revenue refunding bonds from the California State Public Works Board.

The competitive calendar is led by Rutherford County, Tennessee, with $175 million of GOs.

Secondary trading

Maryland 5s of 2024 at 3.56%-3.52%. NYC 5s of 2024 at 3.46% versus 3.30% on 9/7. Washington 5s of 2025 at 3.55%-3.50%.

Massachusetts 5s of 2028 at 3.06%. Triborough Bridge and Tunnel Authority 5s of 2028 at 3.22%. Connecticut 5s of 2029 at 3.34%-3.31%.

DASNY 5s of 2032 at 3.46% versus 3.53% Thursday. California 5s of 2033 at 3.32%. Frisco, Texas, 5s of 2033 at 3.44%.

California 5s of 2052 at 4.16% versus 4.18% Thursday. Massachusetts 5s of 2052 at 4.35%-4.34% versus 4.36% Thursday and 4.18%-4.15% on 9/8.

AAA scales

Refinitiv MMD’s scale was cut up to five basis points: The one-year was at 3.45% (+3) and 3.37% (+5) in two years. The five-year was at 3.12% (+2), the 10-year at 3.16% (unch) and the 30-year at 4.07% (unch) at 3 p.m.

The ICE AAA yield curve was cut one to three basis points: 3.46% (+3) in 2024 and 3.39% (+3) in 2025. The five-year was at 3.12% (+2), the 10-year was at 3.14% (+2) and the 30-year was at 4.11% (+1) at 4 p.m.

The S&P Global Market Intelligence (formerly IHS Markit) municipal curve was cut up to five basis points: 3.46% (+3) in 2024 and 3.37% (+5) in 2025. The five-year was at 3.14% (+3), the 10-year was at 3.16% (unch) and the 30-year yield was at 4.07% (unch), according to a 3 p.m. read.

Bloomberg BVAL was cut up to two basis points: 3.41% (+2) in 2024 and 3.33% (+1) in 2025. The five-year at 3.06% (+2), the 10-year at 3.13% (unch) and the 30-year at 4.11% (+1) at 4 p.m.

Treasuries were firmer.

The two-year UST was yielding 5.111% (-3), the three-year was at 4.803% (-5), the five-year at 4.561% (-6), the 10-year at 4.433% (-5), the 20-year at 4.707% (-5) and the 30-year Treasury was yielding 4.522% (-4) near the close.

Primary to come

The Texas Water Development Board (/AAA/AAA/) is set to price Wednesday $1.003 billion of state water implementation revenue fund bonds, consisting of $998.125 million of tax-exempts, Series 2023A, serials 2024-2038, terms 2039, 2040, 2041, 2042, 2043, 2044, 2046, 2048, 2051, 2053 and 2058, and $5.095 million of taxable, Series 2023B, serials 2024-2038, terms 2043 and 2053. Wells Fargo Bank.

The Florida Development Finance Corp. is set to price Tuesday $770 million of Brightline Florida Passenger Rail Expansion Project revenue bonds, Series 2023C. Morgan Stanley.

The New York City Municipal Water Finance Authority (Aa1/AA+/AA+/) is set to price Wednesday $630.495 million of water and sewer system second general resolution revenue bonds, Fiscal 2024 Series AA, consisting of $257.585 million of Series AA-1, serial 2053; $161.340 million of Series AA-2, serials 2030 and 2035; and $211.570 million of Series AA-3, serials 2034, 2043 and 2048. Raymond James & Associates.

The California State Public Works Board (Aa3/A+/AA-/) is set to price Wednesday $625.235 million of various capital projects lease revenue refunding bonds, 2023 Series C. Goldman Sachs.

New York State is set to price Thursday $542.865 of GOs, consisting of $213.135 million of tax-exempts, Series 2023A, serials 2025-2041; $236.135 of tax-exempts, Series 2023B, serials 2025-2041; $83.435 million of tax-exempt refunding bonds, Series 2023C, serials 2024-2042; and $10.160 million of taxables, Series 2023D, serial 2024. BofA Securities.

The Wayne County Airport Authority (A1//A/AA-/) is set to price Wednesday $375.025 million of airport revenue bonds on behalf of the Detroit Metropolitan Wayne County Airport, consisting of $108.360 million of Series A, serials 2026-2043, terms 2048; $82.470 million of Series B, serials 2026-2043, term 2048; $137.760 million of Series C, serials 2024-2042; $18.225 million of Series D, serials 2024-2037; and $28.210 million of Series E, serial 2028. Siebert Williams Shank & Co.

The Missouri Health and Educational Facilities Authority (A1/A+//) is set to price Tuesday $294.260 million of Mercy Health Facilities revenue bonds. J.P. Morgan Securities.

The Pennsylvania Economic Development Financing Authority (/A-//) is set to price Wednesday $150 million of solid waste disposal revenue bonds, Series 2021A-2, serial 2046. BofA Securities.

Fort Myers, Florida, (Aa3/AA-//) is set to price Tuesday $139.430 million of utility system refunding and revenue bonds, Series 2023, serials 2029-2043, terms 2048 and 2053. Raymond James & Associates.

Durham, North Carolina, (Aa1/AA+/AA+/) is set to price Thursday $128.300 million of limited obligation bonds, Series 2023, serials 2024-2043. PNC Capital Markets.

The San Francisco Public Utilities Commission (/AA/AA-/) is set to price Wednesday $121.660 million of power revenue bonds, 2023 Series A. J.P. Morgan Securities.

Competitive

Rutherford County, Tennessee, (Aaa/AA+//) is set to sell $175 million of GOs at 10:30 a.m eastern Wednesday.