Municipals were little changed Tuesday amid an active primary market that saw the retail pricing of $889 million deal from the Dormitory Authority of the State of New York. U.S. Treasuries were firmer in spots and equities ended in the red.

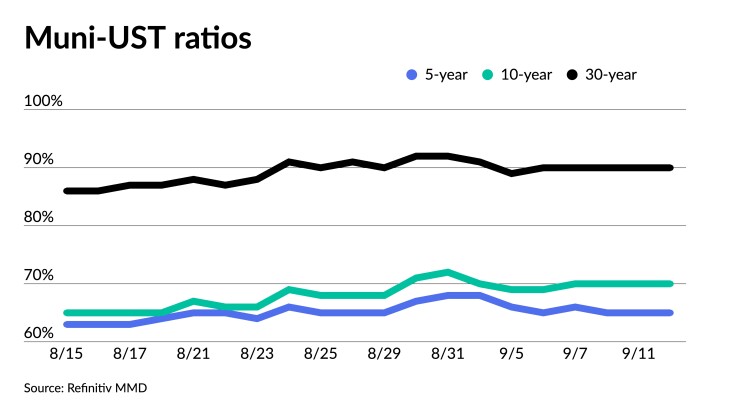

The two-year muni-to-Treasury ratio Tuesday was at 63%, the three-year was at 64%, the five-year at 65%, the 10-year at 70% and the 30-year at 90%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the two-year at 64%, the three-year at 65%, the five-year at 65%, the 10-year at 69% and the 30-year at 90% at 3 p.m.

As September progresses, investors are back in action, waiting for both economic data and to take advantage of higher returns, a Wisconsin money manager said.

“Participants are closely watching for direction from Treasuries and economic data,” he said. “Still, current yields are attractive to many investors — particularly when adjusted for top taxpayers.”

Despite steady outflows from municipal mutual funds for most of the entirety of 2023, retail demand persists, he said.

“Supply remains very manageable as most municipalities don’t need to borrow or refinance,” he said. “The demand side remains less certain.”

Treasury bills and money markets have both captured the attention of some investors and equities have performed well, possibly capturing some of the inflows that may otherwise have flowed into municipals, he noted.

“Market participants should take the Fed at its word that restrictive policy may need to stay in place longer than may have been previously expected,” he said. “Tight policy should impact the yield curve, as well as credit views by market participants.”

He said municipal fundamentals are entering the current period on stronger footing than the last time the Fed materially tightened between 2004 and 2006 to slow the economy.

Last week’s holiday-shortened week was “defined by higher Treasury rates, stronger economic indicators and approximately [$798] million in outflows, which set the framework for higher municipal yields across the entire curve,” said Robert Roffo, portfolio manager at SWBC Investment Co.

However, from a supply perspective, September started off well thanks to $2.6 billion of various purpose general obligation bonds from California, said Matt Fabian, a partner at Municipal Market Analytics. Other large deals from last week included $1.1 billion of consolidated bonds from the Port Authority of New York and New Jersey and $1 billion of gas supply revenue bonds from Main Street Natural Gas.

But while several billion-dollar deals were the focus last week, the market is lacking in conviction, according to Greg Shuman, partner and portfolio manager at Lord Abbett.

“The ratios are relatively rich on the front end, fund flows are still modestly negative, the primary deals are getting done, and the secondary feels relatively sluggish,” he said late Friday.

“These factors are resulting in a relatively patient buyer base, likely in anticipation of the potential for increasing supply in September,” Shuman added.

For tax-exempt issuance in 2023 to equal or exceed last year’s, Fabian said monthly issuance for the remainder of the year will need to see at least as much supply strength as August. Issuance in August totaled $36.5 billion, the highest monthly issuance year-to-date.

“That optimistic perspective may be difficult to sustain, however,” he said. “The 30-day ahead new-issue supply calendar is back below recent years’ rolling averages and both real and rhetorical narratives about higher costs/weaker growth may discourage governments’ new money plans into next year.”

Bond Buyer 30-day visible supply was at negative $9.296 billion on Monday.

A relapse to low supply would “bolster strong nominal and exceptional relative performance but would provide more difficult reinvestment conditions for current portfolios,” he said.

Product constraints remained “endemic” in August and may be behind MUB net creations’ “solid recent growth,” he said.

Like 2022, accounts are again favoring exchange-traded funds over muni mutual funds “for their lower costs and structural liquidity, and, perhaps, their use as transitory allocations while investors wait for alternatives … to become more attractive,” Fabian noted.

While supply this week is “softer,” uncertainty and volatility may prevail once more due to “yields still not exciting longer-term investors,” he said.

In the primary market Tuesday, BofA Securities held a one-day retail order for a downsized deal of $889.440 million of tax-exempt general purpose state personal income tax revenue bonds from the Dormitory Authority of the State of New York (Aa1/AA+//), with 5s of 2027 at 3.06%, 5s of 2028 at 3.09%, 5s of 2033 at 3.36%, 5s of 2038 at 3.89% and 4s of 2042 at 4.30%, callable 3/15/2033.

Morgan Stanley priced for the California Health Facilities Financing Authority (Aa3/AA-/AA $261.160 million of Stanford Health Care revenue bonds, Series 2023A, with 5s of 8/2033 at 3.20%, noncall.

BofA Securities priced for Grand Forks, North Dakota, (Baa3//BBB-/) $150 million of Altru Health System revenue bonds, with 5s of 12/2026 at 3.69%, 5s of 2028 at 3.73%, 5s of 2033 at 3.99%, 5s of 2038 at 4.69%, 5s of 2043 at 4.91%, 5s of 2048 at 5.02%, 5s of 2053 at 5.10% and 5.42s of 2053 at par, callable 12/1/2033.

J.P. Morgan priced for the Arlington County Industrial Development Authority, Virginia (/A+/AA-/) $150 million of VHC Health hospital revenue bonds, with 5s of 7/2053 with a mandatory put date of 7/1/2031 at 3.76%, callable 7/1/2030.

RBC Capital Markets priced for Arlington Higher Education Finance Corp., Texas, (/AAA//) $106.040 million of Trinity Basin Preparatory education revenue bonds, with 5s of 8/2025 at 3.52%, 5s of 2028 at 3.42%, 5s of 2033 at 3.60%, 5s of 2038 at 4.14%, 5s of 2043 at 4.40%, 5s of 2048 at 4.56% and 4.5s of 2053 at 4.75%, callable 8/15/2023.

In the competitive market, the Greenville County School District, South Carolina, sold $169.845 million of GOs to Wells Fargo Bank, with 5s of 6/2024 at 3.50%, noncall.

Minneapolis sold $114.925 million of GO bonds to Citigroup Global Markets, with 5.5s of 12/2023 at 3.40%, 5.5s of 2028 at 3.00%, 5.5s of 2033 at 3.15%, 5s of 2038 at 3.65% and 4s of 2042 at 4.12%, callable 12/1/2031.

Secondary trading

Maryland 5s of 2024 at 3.28%. DASNY 5s of 2024 at 3.38%. Ohio 5s of 2025 at 3.25% versus 3.30% Monday.

LA DWP 5s of 2027 at 2.76%-2.75%. NYC TFA 5s of 2028 at 3.02%. Ohio 5s of 2028 at 3.03%.

Texas 5s of 2033 at 3.22%. Tennessee 5s of 2034 at 3.17%-3.11%. NYC 5s of 2034 at 3.38%.

San Jose Financing Authority 5s of 2047 at 3.80% versus 3.81% on 8/28. Massachusetts 5s of 2048 at 4.16%-4.15% versus 4.05% on 9/1 and 4.08% on 8/30. Washington 5s of 2048 at 4.18%-4.16% versus 4.28%-4.20% Thursday and 4.06%-4.07% on 8/30.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 3.25% and 3.13% in two years. The five-year was at 2.88%, the 10-year at 2.98% and the 30-year at 3.92% at 3 p.m.

The ICE AAA yield curve was cut up one to two basis points: 3.28% (+1) in 2024 and 3.19% (+1) in 2025. The five-year was at 2.91% (+1), the 10-year was at 2.96% (+2) and the 30-year was at 3.95% (+2) at 3 p.m.

The S&P Global Market Intelligence (formerly IHS Markit) municipal curve was unchanged: 3.26% in 2024 and 3.14% in 2025. The five-year was at 2.89%, the 10-year was at 2.98% and the 30-year yield was at 3.91%, according to a 3 p.m. read.

Bloomberg BVAL was cut unchanged: 3.25% in 2024 and 3.16% in 2025. The five-year at 2.88%, the 10-year at 2.90% and the 30-year at 3.90% at 3 p.m.

Treasuries were firmer.

The two-year UST was yielding 5.002% (+2), the three-year was at 4.674% (-2), the five-year at 4.409% (flat), the 10-year at 4.264% (-2), the 20-year at 4.535% (-3) and the 30-year Treasury was yielding 4.345% (-3) at 3 p.m.

Primary to come

Central Plains Energy Project (Aa2///) is set to price $621.255 million of Project No. 4 taxable gas project revenue refunding bonds. Goldman Sachs.

Charlotte (Aa3//AA-/) is set to price Thursday $372.115 million of Charlotte Douglas International Airport revenue bonds, consisting of $260.175 million of non-AMT bonds, Series 2023A, serials 2025-2043, terms 2048 and 2053, and $111.940 million of AMT bonds, Series 2023B, serials 2025-2043, terms 2048 and 2053. BofA Securities.

Honolulu (/AA+/AA/) is set to price Wednesday $188.835 million of senior green wastewater system revenue bonds, serials 2028-2043, terms 2048 and 2053. BofA Securities.

The Ohio Water Development Authority (Aaa/AAA//) is set to price Thursday $150 million of Ohio Drinking Water Assistance Fund sustainability revenue bonds, Series 2023A. Jefferies.

The Indiana Public Schools Multi-School Building Corp. (/AA+//) is set to price Wednesday $127.040 million of unlimited ad valorem property tax first mortgage social bonds, serials 2024 and 2029-2043, insured by Indiana State Aid Intercept Program. Stifel, Nicolaus & Co.

Competitive

The Las Vegas Valley Water District (Aa1/AA//) is set to sell $184.830 million of general obligation limited tax water bonds at 10:45 a.m. eastern Wednesday.

The Dublin Unified School District, California, is set to sell $145 million of Election of 2020 GOs, Series B, at 12 p.m. Wednesday.

Montgomery County, Maryland, is set to sell $280 million of consolidated public improvement bonds, Series 2023A, at 10 a.m. eastern Thursday.

Wichita, Kansas, is set to sell $113.875 million of GO temporary notes at 10:30 a.m. Thursday.